ETSware

Create and issue digital securities

- Issue digital securities tailored to your business model and relevant regulatory requirements

- Streamline the capital raising process with support from team of proven technologists, Wall Street veterans and crowdfunding pioneers

- Leverage additional compliance features from the Horizon KYC, AML, Cap Table Management, and Secondary Trading integrated platforms

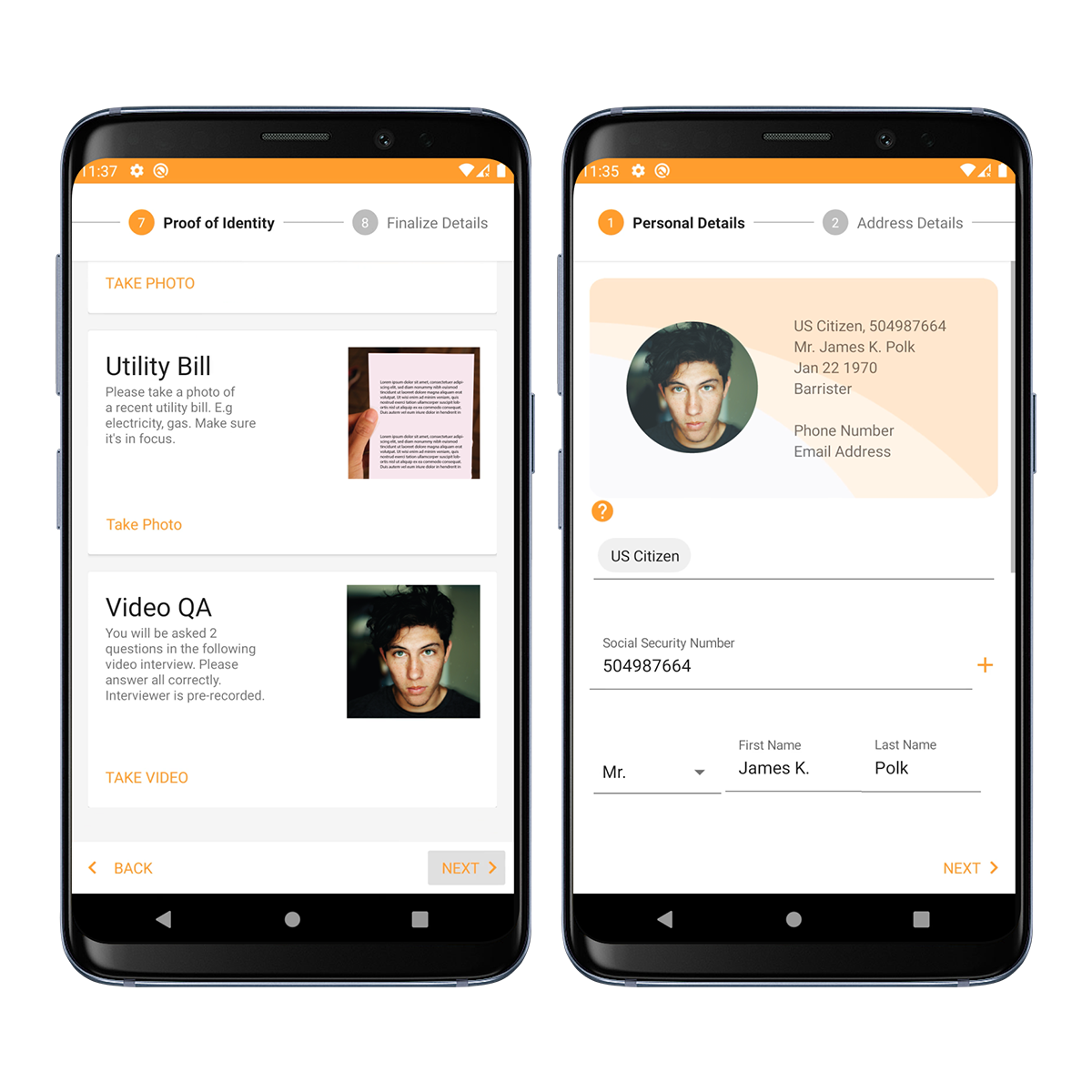

KYCware

Onboard your investors with our next gen KYC compliance app

- Onboard and verify investors through a high-tech, high-touch smartphone app branded to your company

- Verify your users with advanced ID, document & identity verification technology

- Comply with global KYC compliance regulations and prevent third-party access to sensitive data

AMLcop

Screen users against our proprietary AML database

- Continually screen users against a proprietary database of global sanctions, politically exposed persons (PEPs), and watchlists

- Increase accuracy and reduce false positives with a regulator-aligned due diligence process

- Clear and manage individuals through a user-friendly web portal

Custodyware

Compliantly manage digital securities with our cap table management and dividend payment platform

- Enable your transfer agent or global nominee to manage securities, pay dividends, and make ATS-trading transfers for digital securities

- Protect investors and issuers with transparent and immutable storage of up-to-date shareholder records.

- Seamlessly move securities from custody to any Horizon-powered, regulated ATS for compliant secondary trading

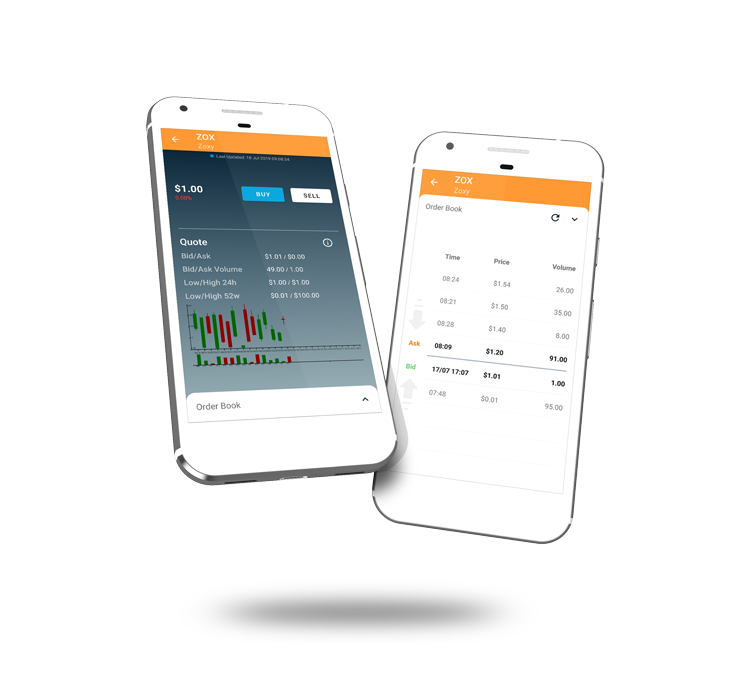

OpenOrderBook

Exchange and trading app technology

- Unlock secondary market liquidity for issuers and their investors with a global network of accessible trading venues

- Experience trading with no short selling, no payment for order flow, or other market manipulations enforced by smart-contract technology

- Integrate Open Order Book with Horizon’s in-house suite of KYC/AML investor onboarding, and cap table management solutions for streamlined issuance and trading

Secondary Trading

Secondary Trading Securities Issuance

Securities Issuance Know Your Customer 'KYC'

Know Your Customer 'KYC' Anti-Money Laundering 'AML'

Anti-Money Laundering 'AML' Cap Table Management for Transfer Agents

Cap Table Management for Transfer Agents